Introduction

In the vast landscape of mutual funds, where options abound and investment strategies vary, Large & Mid Cap Funds emerge as a compelling choice for individuals seeking a nuanced approach to wealth creation. In this comprehensive exploration, we will unravel the intricacies of Large & Mid Cap Funds, breaking down the complexities to make them accessible to every common man.

Large Cap Companies and Large Cap Mutual Funds

Large Cap Companies

Large-cap companies, short for large capitalization companies, refer to companies in the Top 100 as per their market capitalization. These companies typically have a market cap of above 20,000 crore rupees.

Market capitalization is calculated by multiplying the company’s current stock price by the total number of outstanding shares.

Large-cap companies are characterised by their substantial size, stability, and established presence in their respective industries. These companies are often considered industry leaders and tend to have a global reach. Examples of large-cap companies include well-known names like Reliance, TCS, HDFC Bank, and ICICI Bank.

Investors often view large-cap stocks as relatively stable compared to smaller companies, making them a popular choice for conservative investment portfolios.

Large Cap Mutual Funds

Large Cap Mutual Funds predominantly invest in the equity of large cap companies. These companies are usually among the top 100 firms in India in terms of market capitalization.

These funds invest a significant portion of their portfolio, often more than 80%, in equities or equity-related instruments of these large corporations. The remainder of the portfolio is diversified across other financial instruments such as debt securities and money market instruments, which contribute to risk mitigation and balance.

Target Investors

Large Cap Mutual Funds are suitable for investors looking to participate in the growth of India’s leading businesses. They cater to those preferring a relatively balanced investment approach with a focus on stability.

Mid Cap Companies and Mid Cap Mutual Funds

Mid Cap Companies

Mid-cap companies, short for mid-capitalization companies, fall between large-cap and small-cap companies in terms of market capitalization and refer to companies ranking between 101 and 250 as per their market capitalization. Mid-cap companies generally have a market capitalization ranging from 5k – 20k crore rupees, although these thresholds can vary depending on the definition used by different financial analysts and institutions.

Mid-cap companies are often characterised by a balance between growth potential and a certain level of established stability. These companies are typically beyond the early stages of development but may still be in a phase of expansion and growth. They are considered to have more growth potential compared to large-cap companies but may also carry a higher level of risk than large-caps.

Examples of mid-cap companies can include firms in sectors like technology, healthcare, finance, and consumer goods. Some well-known mid-cap stocks include companies like Zomato, MRF, Bandhan Bank, Astral, HPCL, and Persistent.

Investors interested in a balance of growth opportunities and a more established track record often consider mid-cap stocks as part of a diversified investment portfolio. However, it’s important to note that mid-cap stocks can be more volatile than large-cap stocks.

Mid Cap Mutual Funds

Mid Cap Mutual Funds predominantly invest in the equity of mid-sized companies. These companies typically fall between large-cap and small-cap categories and may rank between 101 and 250 in terms of market capitalization in India.

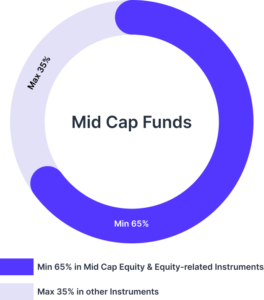

These funds focus on capturing the growth potential of mid-cap stocks by investing a significant portion, a minimum of 65%, in equities or equity-related instruments of these mid-sized corporations. To manage risk and provide balance, the remaining part of the portfolio is diversified across other financial instruments, including debt securities and money market instruments.

In essence, Mid Cap Mutual Funds aim to strike a balance between the growth potential associated with mid-cap stocks and the risk mitigation provided by diversification across different asset classes.

Target Investors

Large & Mid Cap Mutual Funds

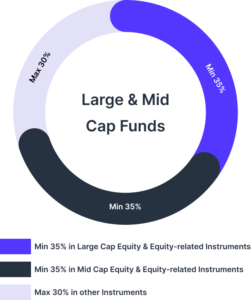

Large Mid Cap Funds are a category of mutual funds that strategically invest in a mix of large-cap and mid-cap companies. These funds seek to balance stability and growth potential by combining the reliability of established large-cap entities with the dynamism and innovation of mid-sized companies.

They invest a minimum of 35% in equities or equity-related instruments of Large cap companies, a minimum of 35% in equities or equity-related instruments of Mid cap companies, and the remaining part of the portfolio is diversified across other financial instruments.

Positioned between traditional large-cap and mid-cap funds, Large Mid Cap Funds aim to offer investors a diversified portfolio that captures the best of both worlds, catering to those seeking a middle ground in terms of risk and return.

Target Investors

Why Choose Large & Mid Cap Mutual Funds

1. Growth Opportunities Aligned with Stability:

Large & Mid Cap Funds present investors with the exciting potential for substantial growth. By tapping into the promising performance of mid-cap stocks while benefiting from the stability of large-cap stocks, these funds offer a balanced approach to wealth creation.

2. Balanced Risk-Return Profile:

The combination of large and mid-cap stocks results in a balanced risk-return profile. Investors can enjoy growth opportunities without subjecting themselves to excessive risk, making these funds suitable for those seeking a measured investment strategy.

3. Adaptability to Market Changes:

Large & Mid Cap Funds are designed to be adaptive. Fund managers actively monitor market conditions and adjust the fund’s composition accordingly. This adaptability ensures that the fund remains responsive to the dynamic nature of the stock market.

4. Leveraging Professional Expertise:

Investors can leverage the expertise of professional fund managers who employ thorough research and analysis to make informed investment decisions. This professional management significantly enhances the potential for returns, providing investors with a sense of confidence in their investment choices.

5. Simplified Diversification for the Common Investor:

Large & Mid Cap Funds simplify the concept of diversification for the common investor. It’s akin to having a mix of stable, reliable giants and promising up-and-comers in your investment portfolio, all working together to achieve your financial goals.