Quant Flexicap Fund is a popular Open ended equity scheme that invests in companies across Large, Mid and Small Caps.

The Scheme invests in a portfolio that includes Large Cap, Mid Cap, and Small Cap companies, aligning with the investment manager’s perspectives on the macro economy. The key focus is on market sentiment, interpreted through quant Money Managers’ predictive analytical tools and macro indicators. The strategy emphasises identifying companies with strong, sustainable competitive advantages in solid businesses with sound management. Fund managers employ a dynamic investment strategy, adopting defensive or aggressive stances depending on the overall risk-on/risk-off environment. In a risk-off scenario, the scheme may significantly invest in money market instruments to safeguard investor interests.

The portfolio is consistently reviewed based on the macro-economic environment, with changes made according to data from our analytics and at the fund manager’s discretion. Portfolio adjustments include both partial and complete sales and purchases of existing stocks, as well as acquisitions of new stocks, if necessary. In response to the prevailing risk-on/risk-off environment, the scheme also engages in strategic sector rotation to achieve risk-adjusted returns.

The Scheme invests in a portfolio that includes Large Cap, Mid Cap, and Small Cap companies, aligning with the investment manager’s perspectives on the macro economy. The key focus is on market sentiment, interpreted through quant Money Managers’ predictive analytical tools and macro indicators. The strategy emphasises identifying companies with strong, sustainable competitive advantages in solid businesses with sound management. Fund managers employ a dynamic investment strategy, adopting defensive or aggressive stances depending on the overall risk-on/risk-off environment. In a risk-off scenario, the scheme may significantly invest in money market instruments to safeguard investor interests.

The portfolio is consistently reviewed based on the macro-economic environment, with changes made according to data from our analytics and at the fund manager’s discretion. Portfolio adjustments include both partial and complete sales and purchases of existing stocks, as well as acquisitions of new stocks, if necessary. In response to the prevailing risk-on/risk-off environment, the scheme also engages in strategic sector rotation to achieve risk-adjusted returns.

Key Features and Benefits of Investing in the Quant Flexi Cap Fund

Quant Flexi Cap Fund offers several key features and benefits that make it an attractive investment option for investors. Let’s take a closer look:

1. Flexibility to invest across sectors and market capitalizations

One of the standout features of Quant Flexi Cap Fund is its flexibility when it comes to investing in different sectors and market capitalizations. This allows the fund managers to take advantage of opportunities across various segments of the market and adjust the portfolio allocation based on market conditions.

2. Use of Adaptive Asset Allocation model

The fund employs an Adaptive Asset Allocation model, which enables tactical movement between large-cap, mid-cap, and small-cap stocks. This dynamic approach helps optimize returns by capitalizing on the potential growth opportunities presented by different segments of the market.

Example: During periods of economic expansion, the fund may increase its exposure to mid-cap and small-cap stocks to benefit from their growth potential. Conversely, during periods of market volatility, the fund may shift towards large-cap stocks for stability.

3. Potential for long-term growth and wealth creation

Quant Flexi Cap Fund aims to generate consistent returns over the long term. By investing in a diversified portfolio of large-cap, mid-cap, and small-cap companies, the fund seeks to capture growth potential across different market cycles. This makes it suitable for investors with a medium to long-term investment horizon who are looking to build wealth over time.

Example: By investing in companies across different sectors and market capitalizations, the fund can capture growth opportunities from various segments of the economy. This broad-based approach helps mitigate concentration risk and enhance potential returns.

1. Flexibility to invest across sectors and market capitalizations

One of the standout features of Quant Flexi Cap Fund is its flexibility when it comes to investing in different sectors and market capitalizations. This allows the fund managers to take advantage of opportunities across various segments of the market and adjust the portfolio allocation based on market conditions.

2. Use of Adaptive Asset Allocation model

The fund employs an Adaptive Asset Allocation model, which enables tactical movement between large-cap, mid-cap, and small-cap stocks. This dynamic approach helps optimize returns by capitalizing on the potential growth opportunities presented by different segments of the market.

Example: During periods of economic expansion, the fund may increase its exposure to mid-cap and small-cap stocks to benefit from their growth potential. Conversely, during periods of market volatility, the fund may shift towards large-cap stocks for stability.

3. Potential for long-term growth and wealth creation

Quant Flexi Cap Fund aims to generate consistent returns over the long term. By investing in a diversified portfolio of large-cap, mid-cap, and small-cap companies, the fund seeks to capture growth potential across different market cycles. This makes it suitable for investors with a medium to long-term investment horizon who are looking to build wealth over time.

Example: By investing in companies across different sectors and market capitalizations, the fund can capture growth opportunities from various segments of the economy. This broad-based approach helps mitigate concentration risk and enhance potential returns.

Fund Details

Minimum Investment Amount

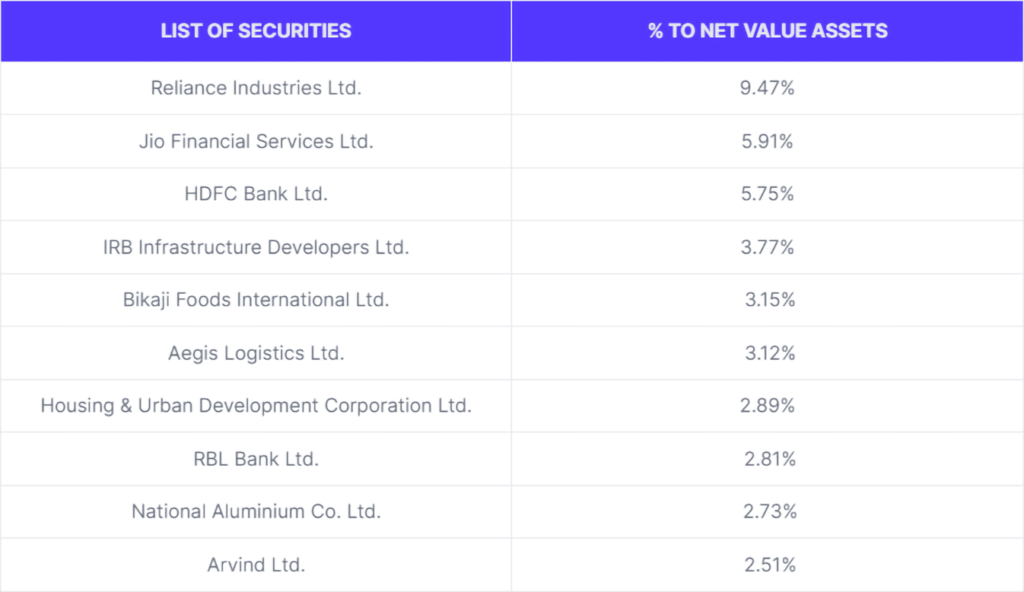

Top Stock Holdings

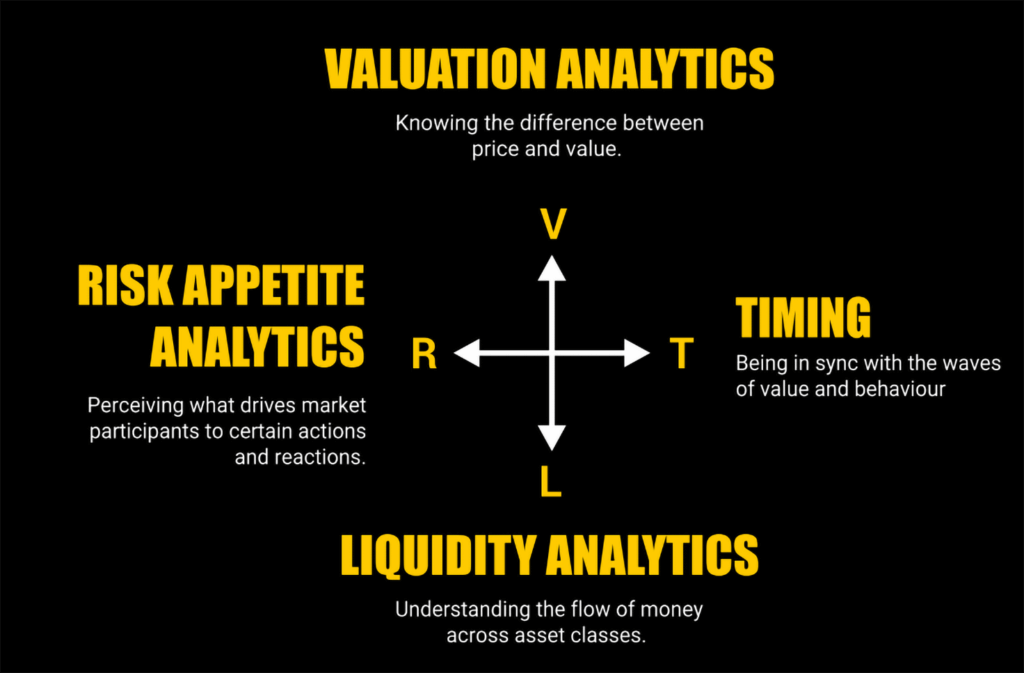

VLRT Framework

All investment decisions are based on quant money managers’ investment framework – VLRT. In the face of this uncertainty and complexity,

we have found consistent success by studying markets along four dimensions as opposed to limiting ourselves to any one school of thought:

1. Valuation Analytics: Knowing the Difference Between Price and Value

Valuation analytics involve assessing whether the current price of a stock accurately reflects its intrinsic value. This dimension focuses on identifying companies that are undervalued or overvalued by the market. Key elements include:

Fundamental Analysis: Evaluating financial statements, earnings reports, and other financial data to determine a company’s actual worth. Discounted Cash Flow (DCF) Analysis: Projecting a company’s future cash flows and discounting them to present value. Comparative Analysis: Comparing a company’s valuation ratios (like P/E, P/B, EV/EBITDA) to industry peers to identify relative value.

Valuation analytics involve assessing whether the current price of a stock accurately reflects its intrinsic value. This dimension focuses on identifying companies that are undervalued or overvalued by the market. Key elements include:

2. Liquidity Analytics: Understanding the Flow of Money Across Asset Classes

Liquidity analytics focus on monitoring and understanding how money flows in and out of various asset classes and markets. This involves:

Market Depth: Analyzing the volume of trades to understand the ease of buying or selling assets without significantly affecting their price. Flow of Funds: Tracking where large institutional investors are moving their money (e.g., from bonds to equities) to predict market trends. Economic Indicators: Monitoring indicators such as interest rates, inflation rates, and monetary policies that influence liquidity in the markets.

Liquidity analytics focus on monitoring and understanding how money flows in and out of various asset classes and markets. This involves:

3. Risk Appetite Analytics: Perceiving What Drives Market Participants to Certain Actions and Reactions

Risk appetite analytics involve gauging the risk tolerance and sentiment of market participants to predict their actions. This includes:

Sentiment Analysis: Using tools to measure market sentiment from news articles, social media, and investor surveys. Volatility Analysis: Studying market volatility to understand how much risk investors are willing to take on. Behavioral Finance: Considering psychological factors that influence investor behavior, such as fear, greed, and herd mentality.

Risk appetite analytics involve gauging the risk tolerance and sentiment of market participants to predict their actions. This includes:

4. Time: Being Aware of the Cycles That Govern How the Other Three Dimensions Interact

Time analytics focus on recognizing and understanding the cyclical nature of markets and how it affects valuation, liquidity, and risk appetite. This involves:

Market Cycles: Identifying phases of market cycles (bull and bear markets) and adjusting investment strategies accordingly. Economic Cycles: Monitoring economic indicators to predict phases of expansion and contraction in the economy. Seasonality: Recognizing seasonal trends that can impact market performance.

Time analytics focus on recognizing and understanding the cyclical nature of markets and how it affects valuation, liquidity, and risk appetite. This involves:

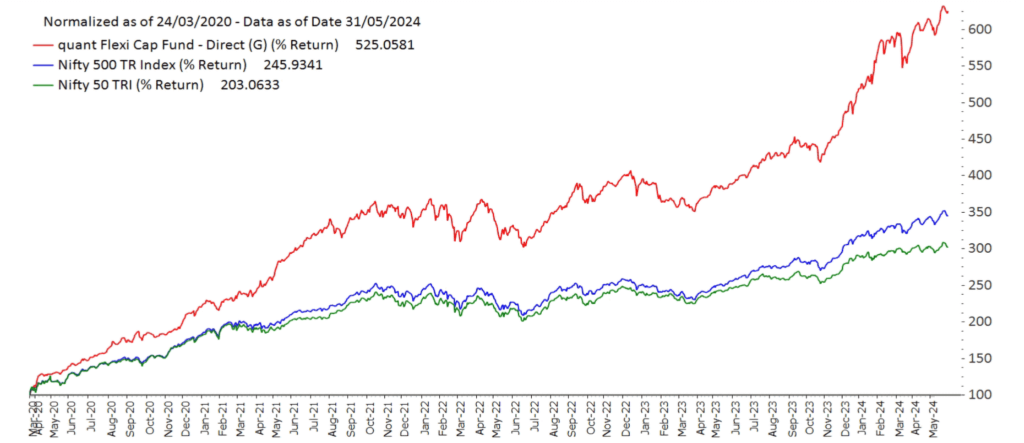

How Does the Scheme Benchmark its Performance

The scheme is a Flexi cap fund investing across Large, Mid and Small Cap stocks. NIFTY 500 TRI has an optimal blend of Large, Mid & Small sized businesses and hence is an appropriate benchmark for the fund.

The Trustee/AMC reserves the right to change the benchmark for the evaluation of the performance of the scheme from time to time, keeping in mind the investment objective of the Scheme and the appropriateness of the benchmark, subject to SEBI guidelines and

other prevalent guidelines.

Performance Review: Is Quant Flexi Cap Fund a Consistent Performer?

When evaluating the performance of Quant Flexi Cap Fund, it is important to consider various factors such as historical returns, recent performance, ratings by experts, and risk analysis. Let’s dive into each of these aspects to assess whether the fund has been a consistent performer.

1. Annualised return

Over a 15-year period, Quant Flexi Cap Fund has delivered an annualized return of 16.1%. This indicates a strong track record of generating consistent returns for long-term investors.

2. Returns in the last 1 year (as of June 2024)

In the past year, Quant Flexi Cap Fund has recorded impressive returns of 61.2%. This demonstrates the fund’s ability to capitalize on market opportunities and deliver substantial growth in a relatively short period.

3. NAV history

By analyzing the historical Net Asset Value (NAV) of Quant Flexi Cap Fund, investors can gain insights into the fund’s performance trends over time. It is advisable to review the NAV history and evaluate any significant fluctuations or consistent growth patterns.

4. Risk analysis

Assessing the risk associated with an investment is crucial for making informed decisions. Two commonly used risk metrics are standard deviation and beta. The standard deviation measures the volatility of returns, while beta indicates how sensitive the fund’s performance is to market movements. Analyzing these metrics can provide valuable insights into the fund’s risk profile.

1. Annualised return

Over a 15-year period, Quant Flexi Cap Fund has delivered an annualized return of 16.1%. This indicates a strong track record of generating consistent returns for long-term investors.

2. Returns in the last 1 year (as of June 2024)

In the past year, Quant Flexi Cap Fund has recorded impressive returns of 61.2%. This demonstrates the fund’s ability to capitalize on market opportunities and deliver substantial growth in a relatively short period.

3. NAV history

By analyzing the historical Net Asset Value (NAV) of Quant Flexi Cap Fund, investors can gain insights into the fund’s performance trends over time. It is advisable to review the NAV history and evaluate any significant fluctuations or consistent growth patterns.

4. Risk analysis

Assessing the risk associated with an investment is crucial for making informed decisions. Two commonly used risk metrics are standard deviation and beta. The standard deviation measures the volatility of returns, while beta indicates how sensitive the fund’s performance is to market movements. Analyzing these metrics can provide valuable insights into the fund’s risk profile.

Who Should Invest in Quant Flexi Cap Fund?

Quant Flexi Cap Fund is suitable for:

Medium to Long-Term Investors: Ideal for those who have an investment horizon of at least 3-5 years, aiming to benefit from the potential growth across various market cycles. Diversification Seekers: Investors looking to diversify their portfolio across Large Cap, Mid Cap, and Small Cap companies, thereby mitigating concentration risk and capturing growth opportunities from different market segments. Strategic Investors: Individuals who value a data-driven, strategic approach to investing, where fund managers dynamically adjust the portfolio based on macro-economic indicators and market sentiment. Risk-Aware Investors: Those who understand and are comfortable with the inherent risks associated with equity investments and are seeking a fund that employs risk management strategies, including sector rotation and adaptive asset allocation. SIP Investors: Those preferring a Systematic Investment Plan (SIP) approach to benefit from rupee cost averaging and disciplined investing.

If you fit into any of these categories and are looking for a versatile, adaptive fund to add to your portfolio, Quant Flexi Cap Fund could be a suitable choice. Use the Simplifin app to get personalized recommendations and leverage our inbuilt advisory tools to make informed investment decisions tailored to your financial goals.