“Debt mutual funds are low-risk instruments that will keep you covered during volatile times in the market”

“Less Volatile and Less Risky”

“Invest Money in fixed Income Instruments”

Introduction

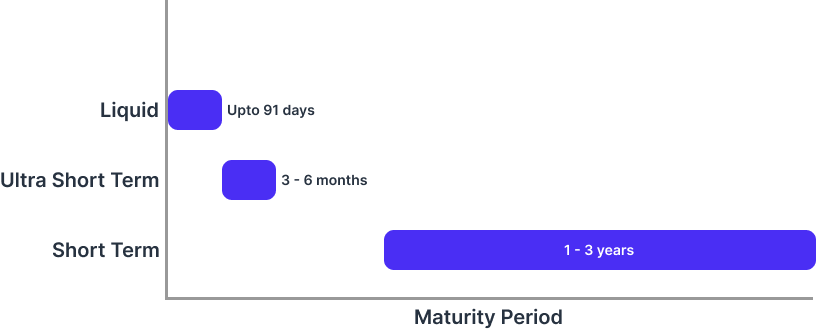

In the dynamic world of finance, investors often seek avenues that balance risk and returns. One such option gaining popularity in India is debt funds. These funds provide stability to investors by investing in a mix of debt securities. In this comprehensive guide, we’ll delve deeper into three types of debt funds: Liquid Funds, Ultra Short Term Funds, and Short Term Funds. We’ll explore what they are, which companies manage them, and why they might be the right choice for you.

Liquid Mutual Funds

What are Liquid Mutual Funds?

Liquid funds are a type of debt mutual fund that primarily invests in short-term money market instruments with a maturity period of up to 91 days. These instruments include Treasury Bills (T-Bills), Commercial Papers, and Certificates of Deposit, making liquid funds ideal for investors seeking high liquidity and low risk.

Companies Offering Liquid Funds in India

Prominent asset management companies like HDFC, ICICI Prudential, SBI Mutual Fund, and Aditya Birla Sun Life manage liquid funds, providing investors with a variety of choices.

Why Choose Liquid Funds?

Liquid funds are suitable for investors with a short-term investment horizon who prioritise safety and liquidity. They are an excellent alternative to traditional savings accounts, offering potentially higher returns with minimal risk. The ease of redemption and low volatility make them a favoured choice for emergency funds or short-term parking of excess funds.

Performance Considerations

Performance considerations in liquid funds go beyond Net Asset Value (NAV), focusing on critical factors like the credit rating of underlying debt securities. Assessing the credit quality is vital, as it directly impacts the fund’s stability and risk. Higher-rated securities enhance safety, while lower-rated ones may offer higher yields with increased risk. Historical performance provides insights into the fund’s resilience across market conditions. Efficient cost management, reflected in lower expense ratios, ensures more returns for investors. Additionally, fund manager expertise is crucial for navigating market intricacies, ensuring alignment with objectives. In evaluating liquid fund performance, considering these aspects empowers investors to make well-informed decisions.

In essence, liquid fund performance hinges on credit ratings, historical resilience, expense ratios, and fund manager expertise. This holistic approach guides investors in aligning their investments with financial goals and risk tolerance, ensuring informed decision-making.