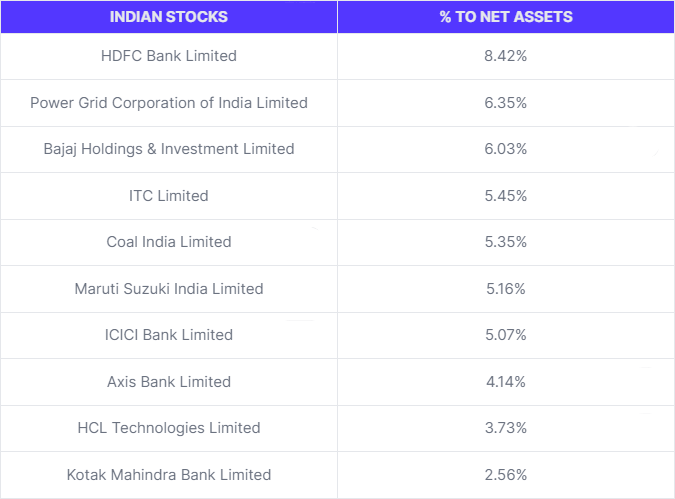

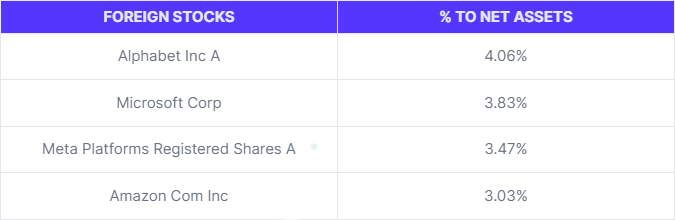

The Parag Parikh Flexi Cap Fund (PPFCF) is a well-known equity mutual fund that offers investors the flexibility to invest across market capitalizations. PPFCF is one of only a handful of Indian mutual fund schemes to invest in a basket of domestic and foreign stocks.

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of equity and Equity Related Securities. The scheme shall be investing in Indian equities, foreign equities, and related instruments and debt securities. Buying securities at a discount to intrinsic value will help to create value for investors. Our investment philosophy is to invest in such value stocks. Long Term refers to an investment horizon of 5 years or more.

The investment objective of the Scheme is to seek to generate long-term capital growth from an actively managed portfolio primarily of equity and Equity Related Securities. The scheme shall be investing in Indian equities, foreign equities, and related instruments and debt securities. Buying securities at a discount to intrinsic value will help to create value for investors. Our investment philosophy is to invest in such value stocks. Long Term refers to an investment horizon of 5 years or more.

Objective of Parag Parikh Flexi Cap Fund

This fund aims to provide long-term capital appreciation by investing in a diversified portfolio of equity and equity-related instruments. It follows a flexible investment strategy, allowing the fund manager to adjust the allocation based on market conditions.

Why equity mutual funds are a popular choice for investors

Equity mutual funds are favoured by investors seeking higher returns over the long term. These funds provide an opportunity to participate in the potential growth of various companies, helping to beat inflation and achieve wealth creation.

How the fund helps in diversifying the investment portfolio

Parag Parikh Flexi Cap Fund diversifies the investment portfolio by spreading investments across large-cap, mid-cap, and small-cap stocks. This diversification helps spread risk and capture opportunities across different market segments.

Key Features of the Parag Parikh Flexicap Fund

In other words, it is a ‘truly’ diversified equity scheme

Parag Parikh Flexi Cap Fund invests in both Indian and foreign stocks to diversify risk and take advantage of global opportunities. By investing internationally, the fund can tap into sectors and companies that may not be available in India, potentially enhancing returns. This strategy also helps in mitigating the impact of domestic market volatility. Additionally, exposure to different economies allows the fund to benefit from growth in various regions, creating a more balanced and resilient portfolio.

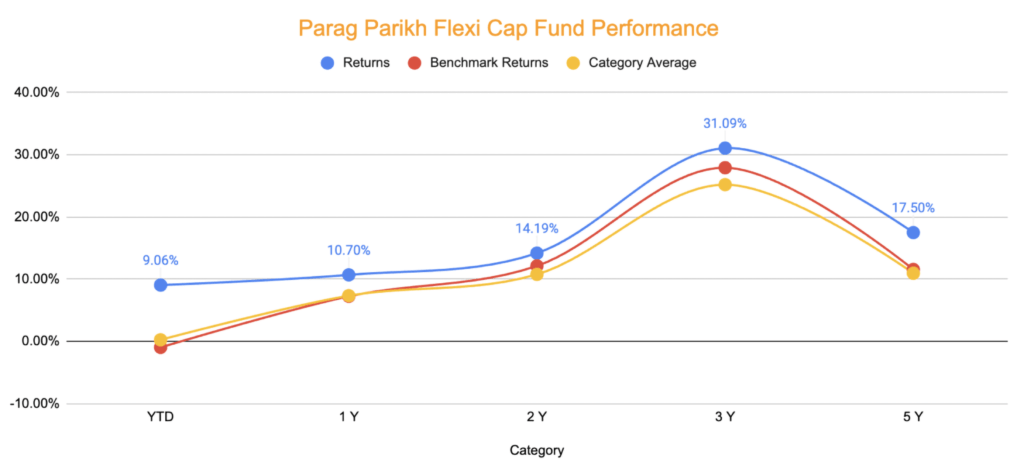

Parag Parikh Flexi Cap Fund Performance

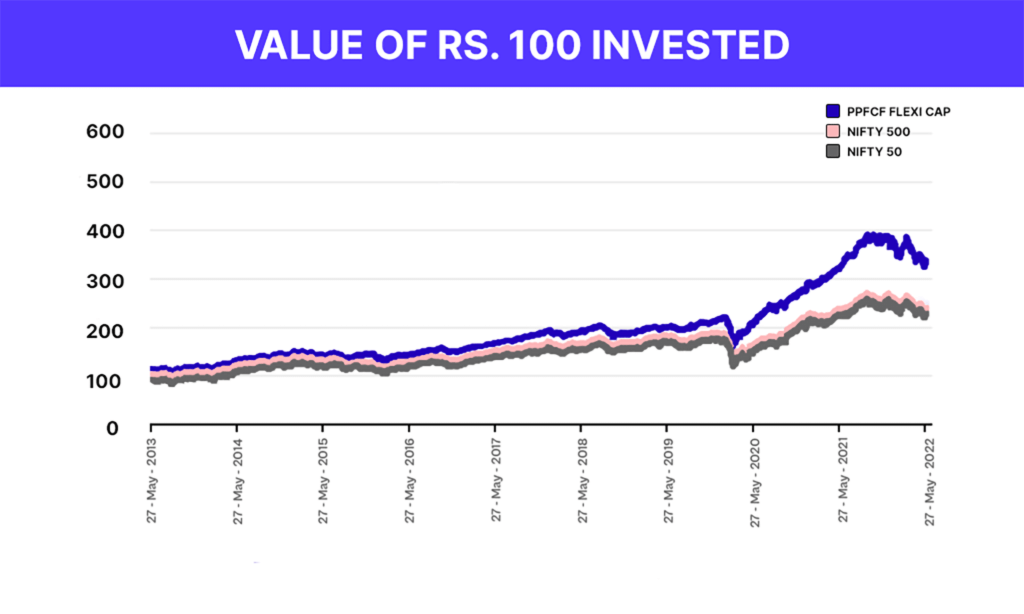

Since its launch in 2013, Parag Parikh Flexi Cap (formerly Parag Parikh Long Term Equity) has consistently outperformed its benchmark and peers. An investment of Rs 100 in this fund has grown to Rs 442, compared to Rs 314 in NIFTY 500 TRI and Rs 290 in NIFTY 50 TRI.

Point-to-point returns don’t fully capture the fund’s consistency, so we examined its rolling returns. These show that the fund has consistently outperformed its benchmark (NIFTY 500 TRI) and broader indexes like NIFTY 50 TRI.

Investing in the Parag Parikh Flexi Cap fund for any 7-year period since 2013 would have yielded an average annual return (CAGR) of 17.5%, outperforming NIFTY 500 TRI and NIFTY 50 TRI by 4-5 percentage points. The fund has never delivered a negative return over a seven-year period, with a minimum return of 14%, well above its benchmark.

Point-to-point returns don’t fully capture the fund’s consistency, so we examined its rolling returns. These show that the fund has consistently outperformed its benchmark (NIFTY 500 TRI) and broader indexes like NIFTY 50 TRI.

Investing in the Parag Parikh Flexi Cap fund for any 7-year period since 2013 would have yielded an average annual return (CAGR) of 17.5%, outperforming NIFTY 500 TRI and NIFTY 50 TRI by 4-5 percentage points. The fund has never delivered a negative return over a seven-year period, with a minimum return of 14%, well above its benchmark.

Risk Management Strategies in Parag Parikh Flexi Cap Fund

The Parag Parikh Flexi Cap Fund is well-known for its commitment to protecting investors’ interests through robust risk management strategies. These strategies include:

A meticulous approach to risk assessment and mitigation Careful analysis of potential risks Proactive measures to mitigate identified risks

By implementing these strategies, the fund aims to ensure that its performance remains resilient even in challenging market conditions, ultimately safeguarding the capital invested by its shareholders.

By implementing these strategies, the fund aims to ensure that its performance remains resilient even in challenging market conditions, ultimately safeguarding the capital invested by its shareholders.

Common Risks in Mutual Fund Investments

In the realm of mutual fund investments, there are common risks that investors should be aware of:

Market volatility: Fluctuations in the prices of securities held by the fund due to market forces Liquidity risk: Difficulty in buying or selling securities at desired prices due to insufficient market activity Credit risk: Potential default by issuers of fixed income securities held by the fund

Understanding these risks is crucial for making informed investment decisions.

Understanding these risks is crucial for making informed investment decisions.

Mitigating Risks in Mutual Fund Investments

To mitigate these risks, investors can consider the following strategies:

Diversification: Spreading investments across different asset classes (such as stocks, bonds, and commodities) and sectors can help reduce the impact of any specific risk on the overall portfolio. Diversification is a widely recognized strategy in this regard. Long-term investment horizon: Having a longer time frame for investment allows for potential recovery from short-term market fluctuations. Staying updated with market trends: Keeping track of economic indicators, industry developments, and company news can provide insights for adjusting investment allocations.

By implementing these risk management strategies, investors can potentially minimize their exposure to various risks and enhance their chances of achieving their financial goals through mutual fund investments.

By implementing these risk management strategies, investors can potentially minimize their exposure to various risks and enhance their chances of achieving their financial goals through mutual fund investments.

This scheme is only suitable for ‘true’ long-term investors…

However, if you are an investor:

Who knows the perils involved in instant gratification For whom the term ‘long term’ means a minimum period of five years. Who gets excited rather than repelled, when stock prices and valuations are low. For whom purchasing a stock is no different from purchasing a business.

Then we urge you to try this scheme as it’s made for you.

With its ability to invest across market capitalizations and sectors, including international markets, it provides a robust platform for growth. Ideal for investors with a minimum five-year horizon who appreciate the potential of low valuations and the business-like approach to stock purchasing, this fund stands out as a compelling choice for those committed to navigating the equity market with patience and strategic insight. If you resonate with these investment principles, the Parag Parikh Flexi Cap Fund might be the right fit for your portfolio.

However, if you are an investor:

With its ability to invest across market capitalizations and sectors, including international markets, it provides a robust platform for growth. Ideal for investors with a minimum five-year horizon who appreciate the potential of low valuations and the business-like approach to stock purchasing, this fund stands out as a compelling choice for those committed to navigating the equity market with patience and strategic insight. If you resonate with these investment principles, the Parag Parikh Flexi Cap Fund might be the right fit for your portfolio.