Introduction

Investing in mutual funds opens a gateway to a diverse array of options, each with its unique characteristics and potential benefits. For the common investor, understanding the nuances of various fund types can be challenging. In this blog post, we’ll demystify the world of mutual funds by exploring Small Cap, Sectoral/Thematic, and Multi-Cap Funds, making investment choices more accessible to everyone.

Small Cap Funds: Unearthing Hidden Gems

What are Small Cap Companies

Small-cap companies are the Davids (David vs Goliath) of the stock market – relatively smaller in size compared to their large-cap counterparts. These companies have a market capitalization between 250-5k crore. While they might lack the global recognition of giants like Delta and Bajaj, small caps often come with a unique advantage: the potential for rapid growth.

What are Small Cap Mutual Funds

Small Cap Funds are mutual funds that focus on investing in stocks of small-cap companies. These companies are usually beyond the top 250 firms in India in terms of market capitalization.

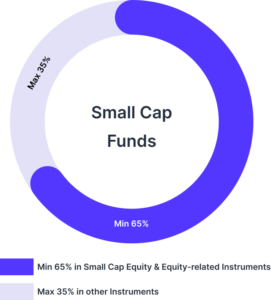

These funds aim to capture the growth potential of these hidden gems, offering investors an opportunity to ride the wave of emerging companies that might become the giants of tomorrow. Minimum investment in equity & equity related instruments of small cap companies- 65% of total assets.

Why Choose Small Cap Mutual Funds

1. High Growth Potential:

Small-cap companies, being in their early stages of growth, have the potential for significant appreciation in their stock prices.

2. Portfolio Diversification:

Including small-cap funds in your portfolio provides diversification, reducing the overall risk by not relying solely on large-cap stocks.

3. Untapped Market Opportunities:

Small caps often operate in niche markets, allowing investors to tap into sectors and industries that might be overlooked in larger funds.

Thematic/Sectoral Funds: Investing with a Purpose

What Do You Mean by Theme/Sector

What are Thematic/Sectoral Funds

Thematic or sectoral funds are mutual funds that concentrate their investments in a particular theme or sector.

These funds are designed for investors who want to align their investment strategy with specific industries or trends.

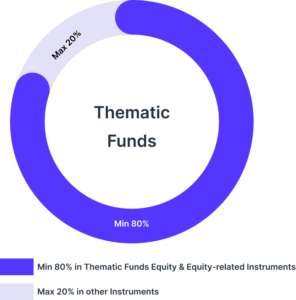

Minimum investment in equity & equity-related instruments of a particular sector/theme is 80% of total assets.

Why Choose Thematic/Sectoral Funds

1. Focused Exposure:

Thematic funds allow investors to focus on sectors or themes they believe will outperform the broader market, providing concentrated exposure to specific industries.

2. Tailored Investment Strategy:

Investors with a particular interest or belief in the growth of a specific sector can tailor their portfolio to align with their convictions.

3. Capitalizing on Trends:

Thematic funds enable investors to capitalize on emerging trends and technological advancements, potentially resulting in higher returns.

Multi-Cap Funds: Striking a Balance

What are Multi-Cap Funds

Multi-Cap Funds take a diversified approach by investing across companies of varying market capitalizations – large, mid, and small caps.

These funds provide flexibility for fund managers to adjust allocations based on market conditions and opportunities.

Minimum investment in equity & equity-related instruments across market caps is 65% of total assets.

Why Choose Multi-Cap Funds

1. Diversification Across Market Caps:

Multi-cap funds offer the benefits of diversification by including companies from different market capitalization segments, reducing overall portfolio risk.

2. Adaptability to Market Conditions:

Fund managers have the flexibility to shift allocations based on changing market conditions, allowing for strategic positioning in different sectors and caps.

3. Potential for Consistent Returns:

By leveraging opportunities across the entire market spectrum, multi-cap funds aim to deliver consistent returns regardless of prevailing market trends.

Conclusion: Finding Your Investment Fit

In the vast landscape of mutual funds, Small Cap, Sectoral/Thematic, and Multi-Cap Funds cater to different investor preferences and objectives. Small Cap Funds offer the allure of high growth potential, Sectoral/Thematic Funds provide focused exposure to specific industries or themes, and Multi-Cap Funds bring a balanced approach with adaptability to market dynamics.

As a common investor, understanding your risk tolerance, investment goals, and time horizon is crucial in selecting the right mutual fund. Whether you’re drawn to the excitement of small-cap potential, the targeted focus of thematic funds, or the adaptability of multi-cap funds, each category has its unique advantages. Diversification remains a key principle, and a well-thought-out combination of these funds can form a robust investment portfolio tailored to your financial aspirations. Before making any investment decisions, it’s always advisable to seek guidance from financial experts and conduct thorough research to ensure alignment with your overall financial strategy.